| Learning from Case Study # 1 (A&M) |

| Meet Arnold and Marie, understand their situation, walk through their decision-making process. |

| The photo below is a perfect depiction of how Arnold feels as he explores early retirement! |

|

| Arnold announces early retirement by end of 2024 |

|

|

I have been fortunate to work with multiple generations of family members within the same families, which has been a great and an enriching thing in my life. That experience applies here.

|

|

When you see words in the middle of a paragraph italicized that means I am sharing my personal thoughts or an observation. When you see this computer, coffee and pen box to the left that means I am choosing to get more seriously sidetracked to teach or review financial planning principles with you the audience. I am trying to carve out that information from the main theme of the case study. I think it needs to be understood; to keep up with me on the case study.

|

I first learned about Vernon and Mary’s grandson Arnold when he was 19 years old (but just on paperwork involving beneficiary designation coded FBO, along with three other siblings). I have enjoyed working with Arnold’s parents as one of my favorite clients, for over forty years. He just lost his mother in September. I did not have the pleasure of meeting Arnold in person until January of 2020 just before covid. That’s when I started helping him and his charming wife Marie with their finances. Arnold just turned 60 years old (happy belated birthday!) and Marie is 61 years old. They have five children between them and some grandchildren too. They have put together a very comfortable life for themselves, including some expensive hobbies and have goals, objectives and plans during their retirement. Those start out with their recent purchase of an $80,000 motor home, with a loan against it, with a payment of about $400.00 a month, that they just agreed to pay off with savings. Their goal of course is to enjoy annual road trips in retirement with the motor home. They have allocated or wish to budget $10,000.00 a year to cover the expenses of those fun vacation road trips. (So right there that is $833.33 a month in our budget nut we must cover with retirement income, well, we will see how that works for them.) They are 100% committed to keeping their current home (not downsizing) and maintaining its mortgage and its payment. Most important, in addition to the new RV and travel expenses, they are committed to at least maintaining their current standard of living throughout their retirement. Keep in mind that this standard of living was established with a two professional income working family.

|

|

Ten years ago, when planning for retirement we always factored in what we planners called, “Income Replacement Ratios, i.e. 70%.” This was a calculated reduction in income and lifestyle during retirement. That concept went out of date like the 8-track tape player. Today none of my successful clients are interested in any reduction in their lifestyles, some even what them enhanced commensurate with their extra free time.

|

A little earlier than expected, Marie retired during covid in the spring of 2020. At the time that was an easy and fearless decision. That was because she was working in a petri dish and the fact that her husband Arnold was still working and earning a salary of $150,000 a year. It all made it a no-brainer and an easy transition.

Marie has accomplished setting herself up with a nice pension during her career that she started enjoying when she retired. It is $1,918.01 per month before income taxes and she selected the pension option which maximized her monthly payout, but 0% of the income will continue to her (surviving) spouse, should she predecease Arnold. The selection of that option was predetermined factor into the equation, when considering the possibility of converting her life insurance to paid up. In financial planning, it is a concept called "pension maximization" whereby creating the cash flow in the budget to more than fund 100% of the "net cost" of a $250,000.00 life insurance policy on her life for the benefit Arnold to pay off the lion's share of their mortgage with the policy's income tax free proceeds. Also in these more modern policies, should it be needed, most of the death benefit is available to access while one is still alive to pay for long-term care related expenses while staying at home when you are older.

She also successfully accumulated about $400,000.00 in a 401(K), now rolled over to an IRA for herself, earmarked for conservative growth with preservation of capital as her focus. We will review some options for that money to produce income or just leave it going to deal with inflation, depending on some decisions in their overall plan design. That will all be clear soon.

With Arnold’s extra income, he has accomplished setting himself up with two pensions during his career that he will start enjoying now. The first is $1,910.09 per month before income taxes and that is selecting the pension option of 100% of the income continuing to his (surviving) spouse when he dies. The second one is $970.29 per month before taxes and that one also was selected with the pension option of continuing paying 100% to his surviving spouse when he dies. The selection of those options may present one component factor into the equation, when considering in the future, the possibility of converting his life insurance to paid up, depending on other decision is his overall plan design. But in any event lends itself to making his surviving spouse much more financially secure and provided some diversification in their plan design.

In addition, he successfully accumulated $925,364.00 in his 401(k) and the disposition of what to do with those funds, is tracked herein with this case study. We will get down into the weeds and explore each option. This money was moved to a safe-harbor account, four months ago. We did it to avoid a market crash (or any downward adjustment that could screw up his retirement goal) we now see that we are at the top of the market, seen just one day after Trump’s winning of the election. This was done due to our short time horizon, before retirement and giving us time to design the plan, using stable numbers. Ha! this did not mean Trump was able to fix the economy in one day! LOL.

We will explore the allocation blend of these funds for further growth with minimum capital risk and the allocation toward the production of monthly income, that is set up in a way that neither Arnold nor Marie can outlive during their lifetimes.

But for Arnold, as he approaches his decision to retire, he perceives things far differently than Marie did as she was approaching her retirement. Covid came at us fast, but now Arnold has had time to think about this issue. Knowing he will lose that salary on New Year’s Eve this year, is a great concern. He has a high level of situational awareness (to use an aviation term) of the words at the bottom of each page of my website, “If your outgo exceeds your income, your upkeep will be your downfall.”

He wants to quit working in the rat race, for health, sanity reasons, as well as to enjoy the rewards of his hard work while still youthful. (Must be nice!) However, he has explained very clearly that he has no interest, or I should say he wants to avoid getting in a situation where his retirement income, after income taxes is not adequate to meet their living expenses in retirement. We have had some serious conversations about how the risk of inflation is magnified or carries more weight to it when one considers retiring, perhaps five years earlier than average, as in this case. Those conversations have not helped him feel any safer.

|

|

When one retires earlier, they must fund their retirement for a longer period which requires more funding, more money in the nest egg. That is especially true for those who used “Capital Depletion Planning” which designs one’s plan to run out of money and go bankrupt at a curtain age and also can negate one's heirs from a family legacy. Taught to me initially by my grandmother, my clients have all goals set and had their plans designed with the “Capital Retention” structure. That takes a lease capital in the nest egg to have the same income when we are stripping out and spending down the principal. Often when clients subscribe to the more sophisticated "Capital Retention design they elect a more conservative lifestyle for that security.

|

So, as you are now understanding, Capital Retention planning, requires establishment of enough resources that the monthly income (interest, dividends and sometimes rental income) from the nest egg is enough to meet all the expenses of living completely, and still build a reserve to actually increase the nest egg, so it will produce higher interest income in the future. But none-the-less, even when planned out using capital retention, when we retire five years earlier, we have a much longer period to be exposed to the risk of inflation. Therefore, we need a more robust and bulletproof plan to deal with that, since it is much more critical when we have a longer retirement period. One of the best mechanisms to deal with inflation is to not use social security income has a base pay, like it was designed for, initially to live on in retirement, but to add it to the mix in the future, whereby increasing your income in the future when needed in a major way.

Since I am legally a Fiduciary helping them with their retirement planning, as such, I will need to do some seriously accurate financial fact-finding. In order not to risk any jail time, for me, (slight exaggeration) I will be documenting to death that everything I suggest as a path, for them to select, has been in their best interest. This included gathering a complete comprehensive list of every monthly expense they have, with all that data provided by them. Then, I will try to add a large contingency buffer to that list of expenses and make sure that the plan design “so to speak” builds in an effective mechanism to deal with inflation; so, stay tuned, this is going to get much more interesting.

|

They own a beautiful home in a rural area worth or approaching about a $1,000,000.00 which they did a "cash-out" refinance to pay off a complete remodel back in June of 2021. The mortgage is a 30 Year Fixed mortgage obtained from me as a mortgage broker. It currently has a remaining balance of about $400,000.00 with a rate of 2.990%. The Principal and Interest portion of their monthly payment is $1,810.58. Ironically, that was a high rate in those times do to the fact it as a "cash-out" and not just a rate-term refi.

We need to visit about the opportunities the different time periods in the economy can present us. In 2021 the 30 YR Fixed loans where a great buy and those who got one will enjoy that rate locked in for the life of the loan. That is even with the fact that interest rate is double now. Today, in 2024 and maybe in the first half of 2025 the fire sale is with SPIAs (Single Premium Immediate Annuities). This is a program for which you are about to see proposals as part of these plan design options. The income for them, or from them, is factored with one of the components being today's interest rates. The interest rate that the stream of income was built on is fixed for the life of the annuitant (not just 30 years). So, the monthly "payout rate", will remain at that higher level even though in the future such rates may go a lot lower in our economic cycles. This is way for the first time I have showed a few of these to younger people.

It is also super important to understand SIPAs have two other components that they are built on. One of those is the mortality tables factor. Meaning the longer you wait to purchase, in other words the older you are, the higher the payout rate will be. This is also the same concept built into social security income benefits. So the interest rate and the benefit of waiting could result in a wash, up to about a five-year differential. This will be a big consideration at Arnold's age. I will get into what this means later.

|

|

Although, not as easy to follow in a narrative compared to a simple list, you now have a lot of pieces of financial fact-finding data that I collected, income and mortgage, no plans to extinguish mortgage, etc. etc. We need a lot more. So, let’s complete some more of the general fact finding with the "asset" data, then the budget data then melt together the income data, tying it all together.

|

Before we move on, to complete the information you need to see more of the whole picture I will share some more key points, of the information I have from my fact-finding sessions:

Bank account balances after RV loan was paid off: $67,000.00 +

I Savings Bonds: 10,000.00 +

Other tax deferred (93%) liquid asset reserves 100,000.00 + (Six accounts not counting IRAs)

Now we will move on to the budget data collection fact-finding results.

|

Double click on the excel icon to the right and you can view Arnold and Marie's monthly expense on every subject in their lives. As you will see those expenses added up to $8,489.52 per month! Can you believe it, over a $100,000.00 per year, to maintain their current lifestyle, in retirement.

Just in case you do not have access to excel on your desk top computer, I displayed these numbers below the old fashion way, but I am yet to get the numbers aligned straight in the column. But if you are viewing this budget using your smart cell phone, you need to be aware I have had this website for over thirty years, and it is an earlier version and not considered mobile friendly so it will really look weird. So try to view it by clicking on the green excel icon, above to the right.

|

Double click to view Arnold and Marie's budget |

Housing & Personal expenses:

Mortgage P&I payment 1810.58

Property Taxes 553.76

Homeowners Insurance 127.00

Umbrella Insurance Policy 25.00

Electric bill 162.00

Gas or Propane Bill 77.00

Garbage Disposal Bill 38.53

Water Bill 50.00

Septic Tank 0

Landline Phone Bill (included in Streaming Bill) 0

Cable Internet connection (Included in Streaming Bill) 0

Cell phones 157.02

Internet Streaming Services 136.00

For Hire Service Providers, like technician repairing washer/dryer 30.00

Minimum Maintenance home & yard 117.00

Home Repairs 100.00

Church, Synagogue, Charity (Discretionary) 0

Personal/Clothing etc. 153.00

Minimum Gifting for holidays and birthdays, etc.(Discretionary Below) 50.00

Grocery Store Food Purchasing 700.00

Minimum Dinning out and eating on the road locally 325.00

Cash Expenses out of pocket allowances 4 spending 200.00

Membership fees Athletic Clubs 20.00

Entertainment, hobbies (Essential) …see below 4 discretionary 128.80

Lake Connor Park Camping Club 130.00

Beachwood Resort Camping Membership (Sun Retreats) 16.00

Medical & Health Care Expenses

Major Medical insurance premiums prior to Medicare eligibility 88.08

Humana (Type) Drug Card 0

BlueShield (Type) Medicare Gap Policy 0

Individual Dental Policy Premium 25.58

Self-Funding Dental Expense Projection 100.00

Trustmark LTC Premium, Terminated on it 12-31-2024 0

Self-Funding Medical Co-Pays & out of Pocket $198.66. 0

(He has 46K in an HAS to fund this).

Arnold's Automobile & Transportation expenses

Car payment 0

Auto insurance Premium (use 50% of multiple premium) 136.20

Fuel Cost 150.00

Self-Funding for Repairs and maintenance 100.00

Marie's Automobile & Transportation expenses

Car payment 0

Auto Insurance Prem (use 50% of multiple total premium) 136.20

Fuel Cost 150.00

Self-Funding for Repairs and Maintenance 100.00

RV's / Yachts/ Aircraft / Equipment Cost

RV Loan paid off with savings "per recent agreement" 0

Insurance on RV's 65.00

Self-Funding for Repairs and Maintenance 100.00

Other Miscellaneous Expenses

Pasquotank County Property Taxes 32.27

"Fun Budget" $10,000 a year for RV vacations "wish list" 833.33

Gifting, birthdays, Christmas, etc. (See Minimum Gifting above) 50.00

Grandkids Saving commitment 0

Tax Preparation, Accounting & other Professional fees 50.00

Life Insurance Premium 4 Arnold (builds cash values like savings: 565.70

Life Insurance Premium on Life of Marie 500.47

(Life Policies have riders to access death benefits for long-term

care expense protection)

Anticipated additional premiums on auto, home, car & RV: 200.00

Total Monthly expenses = $8,489.52

Let's subtract post-retirement "net" after tax income

that we have using a 22% Tax Rate

Marie's Pension Income $1,918.01 X .78% in taxes = -1,496.04

Marie's $210.99 PM JT net income SPIA using 20% taxes= -168.29

Arnold's $1,910.09 Union Pension net after taxes (.78%) = -1489.87

Arnold's 2nd Pension $970.29 adjusted net after taxes at .78% = -756.83

Short fall in budget overhead (nut to crack) = $4,578.49

If they elected to draw on social security as soon, here are those numbers:

Arnold's Soc Sec income starting in 24 months post-retirement $2,493.00

less taxes of $466.00 = a net of $2,027.00

Marie's Soc Sec income starting 3 months after Arnold's retirement $1,922.00

less taxes of $359.00 = a net of $1,563.00

Total Social Security income if they start it as soon as they can: $4,415.00

|

Then you can see at the bottom I entered their pension income and subtracted that from their monthly expenses. This in general terms shows us how much we need each month to overcome the shortfall, above and beyond that from the capital in their IRA's or from their Social Security resources. As you can see "as is" resulted in a shortfall of $4,578.49 per month, again, without the use of IRA funds to produce income or withdrawals from IRA for income to supplement expenses, and again without any social security benefits being accessed.

Then in part, for future reference I indicated what their social security income would be if they both decided to draw those benefits as soon as eligible. Their income from social security for both of them would total $4,415.00 which looks exciting on the surface, since it is within $163.49 of their expenses, but there are a few issues to address before we address that as a possible solution. The first is we have to pay taxes on that income so the net would be only $3,590.00 which leave us $988.49 short.

That is a shortfall, but it is close enough to explore it as the first option or path (OPTION ONE). If they elect this one, they will have to reach into savings for a while to subsidize that but let's look at the opportunities it presents. To get comfortable with this concession we will earmark the $1,066.17 per month expense for the two life insurance premiums to now being paid by a systematic monthly capital "transfer" from their $100,000+ of their tax deferred 93% liquid account assets, rather than just line item on their list of monthly expenses. That seems painless to me, and I like it and I will modify the budget accordingly. The life policy cash values are already included on that list of accounts. The operative word is "transfer" whereby the account would keep earning, reduce a little for the premium money going out but the policy cash values on the policies and their dividends would be gaining value each month. The overall scenario would be that the tax deferred account asset would this grow overall but not as rapidly. This will allow us to be more successful to stay on track with capital retention and meet the other lifestyle goals in retirement.

While we have a lot of plan design options to work through to see the pros and cons before we could clearly know if that would be the highest and best use of Arnold and Marie's social security resource.

It may be, there is a yin and yang to everything, but it may not we can see as I perform financial litmus tests. But to know if it is the case, we first must structure the plan.

OPTION ONE: To currently exploit their social security resource/asset now, currently, as soon as eligible. This would allow us to have a clear path to use social security income so we could just have Arnold's $925,364.00 of IRA money grow and grow not needing any of it at this time for their retirement.

|

OPTION ONE, illustration is now going to display the rolling over of Arnold's $925,364.00 401(k) into a FIA.

Option one, was the design option that has Arnold and Marie living on their pensions and social security income, while just letting their IRA's grow.

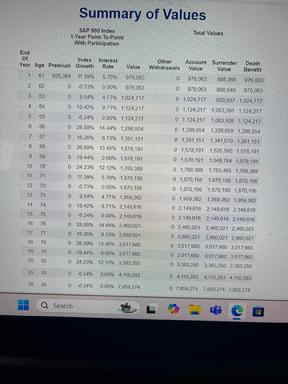

To the right is a pic of the summary of the potential account values if history repeated itself (which you can never, never count on) which shows Arnold accumulating enough money to purchase the nursing home he may be living in for $7,859,274.00 cash at age 95 Lol! That was not his goal or objective.

The pic does not display well so you can double click on the PDF icon below to see how, over time these funds of the potential to really add up.

Again, double click the PDF on the right to open the full original and complete proposal "just" for Arnold's IRA growing. The summary math display can be seen or matched on page 5 of 10 in the "non-guaranteed" column.

|

|

| Ha! By age 95 you could buy the nursing home you are in! |

|

|

Above to the right is a pic with the green coloring on it which is much more realistic.

This is because the summary of Historical Periods is only for a ten-year period. The matches closely the time period which Arnold could delay receiving his social security benefits. This shows the best period accumulating $1,000,000.00 dollars more than he started out with. Again, you cannot count on that repeating itself, and I am not just saying it because I do not think it well. The you can see the worst 10-year period which shows potential growth of over a half a million. The also as you can see show the last period of time is in between.

|

OPTION ONE:

A quick review OPTION ONE was the design that has Arnold and Marie living on their pensions and social security income maintaining their chosen lifestyle, while just letting their IRA's grow.

Click the PDF on the right to open the full original and complete proposal "just" for Arnold's IRA growing.

The key page is 6 of 10, view the "non-guaranteed values" which is the far far right column. This is very interesting as it shows the potential "if" markets hypothetically repeated themselves (which they won't), you would have had your $925,364.00 grow by $844,000.00. Then as seen on page 7 of 10 on the far left "best period" shows it with a value of $1,933,242.00 which is over $1,000,000.00 more than your deposit by the time social security would offer you the max benefit.

|

Double click to open Arnold's Full IRA Proposal |

|

So, you just viewed an educational illustration (not necessarily a recommendation) showing the power of 925k going into a (single account with every egg in one basket) FIA (Fixed Indexed Annuity) and allowed to accumulate without any withdrawals. While seeing (viewing) those numbers in a single account can help make my building block education easier to help you learn things, but it is something in real life I would resist under my watch, that is without the written consent of my client.

So, even though annuities are “very safe,” common-sense investment diversification suggests that we should divide (or place) a portfolio or one’s nest egg in more than one place.

|

Let us review what “very safe” means to me. The positive aspect of the Fixed Indexed Annuity contract is that the Capital Risk is borne by the insurance company who underwrote the contract not my client, the annuitant. Then that insurance company insures and backs that account with its full faith, promises and that is extended to being backed by the General asset of that insurance company not the Annuitant. Then also with Fixed Annuities, the Annuitant is further protected with the State of Washington’s Association fund for up to $500,000.00 per individual (not per annuity), for their deposits in Fixed Annuities including the hybrid spinoff cousin the “Fixed Indexed Annuity” shown here. You can do a Google search own your own, of “Washington Life & Disability Insurance Guaranty Association,” to get the information directly as published by them and not from me officially, for my compliance needs.

I believe all the states have these "association" funds, and Washington has one of the best. I am licensed in WA, OR and AZ and each of those at least have this type of fund for protection. This is "publicly" accessible information that anyone can get. I have printed this information for myself, going back to 1992. which shows it has been around for a while.

So, the takeaway here is I feel this 925k needs to be split between at least two institutions. I also like diversification between plan design scenarios such as accumulation and income accounts. I also live diversification with tax scenarios, i.e. qualified, non-qualified, taxable, tax differed, and tax free, when I can get it.

|

The first would be to put your IRA asset into a SPIA to have level consistent income. The illustration for that is just to the right. The other option other option is to put it into the same type of FIA (Fixed Indexed Annuity) I showed you for OPTION ONE above BUT pull withdrawals of $4,415.00 every month. This is seen on the illustration to the far right. The key page is 6 of 10, view the "non-guaranteed values" which is the far far right column. This is very interesting as it shows the potential if markets hypothetically repeated themselves (which they won't), you would till have your $925,364.00 even after receiving $4,415.00 per month which is how much both of your social security checks would be! The column to the left shows that withdrawal of $52,980.00 per year.

|

|

| Let's talk about what to expect next |

|

| Since I am writing with Italicized font you know I am talking to the audience slightly outside the core case narrative. I have become bored with the computer/coffee/pen photo which I have been using so I am switching to some pics of me. As I explained in the beginning, this is a “real” case study. It is literally a live, active and actual situation. I just let Arnold and Marie know that I have completed the first half, and I wanted to have them visit the site. I told them they (and you too) will need to hit the refresh button on the computer’s browser each time they go on the site to be able to see the last update. I asked them to review my fact-finding data for accuracy and make any correction needed to my perception of their goals and objectives. In addition, I asked them to send me some simply one paragraph emails with questions that I could then build that information into my narrative project to make it as germane for them as possible. I am going to outline below the specific agenda or schedule of items, calculations, illustrations, diagrams and mathematical annualization I plan to post in the next chapter “so to speak” or sections.

I will be diving deeper into the weeds to show the pros and cons of either of the two private sources, to provide your income. They are the SPIA which I will compare and contrast to the option of using a FIA (since they were my last two illustrations show just above) if you subscribe to OPTION TWO. As a reminder protects your social security resource asset by not using it for the next ten years.

|

Then I will likely “try” just jump to comparing those private sources of income you could elect to that of accepting earlier access to your social security benefits. I will illustrate to (us all), which scenario develops the best or highest net worth for your future reserves in later years when you reach your seventies. Hmmm, not sure at the exact moment, but either just before that or just after than I will do a complete review for you of what I feel are the advantages and disadvantages of drawing social security as soon as possible or waiting to age 70, financially and non-financially. Then, after I study them myself, I will provide my opinion which I would do if I was you, if not self-evident automatically. In the meantime, view the one-minute video to the right to see my face in a decision-making moment.

|

Sometimes we must choose a direction |

|